401k contribution calculator per paycheck

If you contribute more money to accounts like these your take-home pay will be less but you may still save on taxes. The VO2 Max Calculator will instantly calculate VO2 Max for you if you can input your time to complete a one mile walk walking as fast as you can and your heart rate immediately after completing the one mile walk.

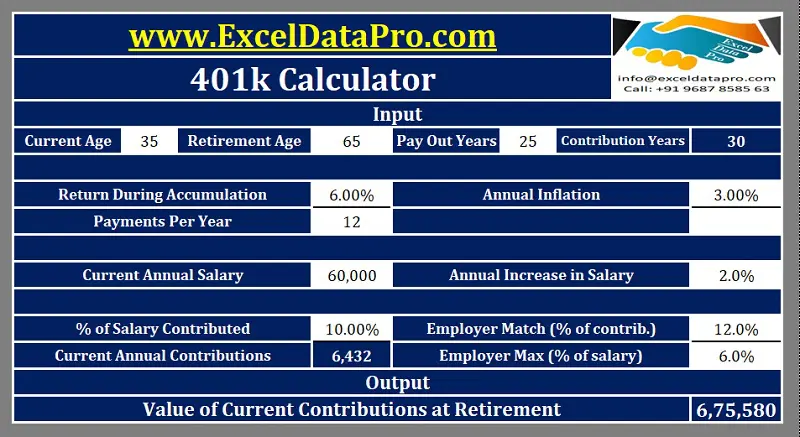

Download 401k Calculator Excel Template Exceldatapro

Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income.

. The maximum catch-up contribution available is 6500 for 2022. How You Can Affect Your Kansas Paycheck There are many ways to increase the size of your paycheck starting with asking for a raise or working additional hours granted you are eligible for overtime. The annual 401k contribution limit is 20500 for tax year 2022 with an.

You can also shelter more of your money from taxes by increasing how much you put in a 401k or 403b. How You Can Affect Your West Virginia Paycheck. If the Square Feet to Cubic Feet calculator was useful to you there are several simple ways for you to share this tool with others or display the results on your own webpage.

You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. VO2 Max Volume Oxygen Max is a measure of how much oxygen a person can use during difficult exercise.

If you are 50 or older you can make a catchup contribution of 6500. VO2 Max is a commonly used. Contribution Calculator Contributing to your workplace 401k is one of the best investment decisions you can make.

This will mean only a half year HSA contribution in 2018 2200 inflation adjustment as I go on Medicare in July. Enter the total of any other before-tax deductions per pay period such as contributions to a Health Savings Account or a Flexible Savings Account. Your annual 401k contribution is subject to maximum limits established by the IRS.

Your household income location filing status and number of personal exemptions. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Use the paycheck calculator to figure out how much to put.

For 2022 the contribution limit for 401k accounts is 20500 per year or 100 of your compensation whichever is less. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. I turn 65 in July 2018.

290 for incomes below the threshold amounts shown in the table. Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA. Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company match.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck. If you consistently find yourself owing.

Due to this if allowed non-exempt. Enter your wage hours and deductions and this net paycheck calculator will instantly estimate your take-home pay after taxes and deductions 2022 rates. The decisions you make when completing your Form.

If you saved that money in a 401k however you would still contribute 417 a month but your paycheck would be reduced by just 333 a month because youve reduced your tax bill by more than 83 each month. Employer contributions do not count toward the IRS annual contribution limit. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

A 401k account is an easy and effective way to save and earn tax deferred dollars for retirement. Take the guesswork out of planning for the cost of flooring roofing or similar jobs. I stay below the ACA cliff with 6500 deductible IRA not Roth contributions and 4400 HSA contribution plus half of self employment taxes keeping me below 4x 11880 this year 2017.

You can just copy and paste. For 2020 the maximum contribution for this type of plan is 19500 per year for individuals under 50 and 26000 for individuals 50 or older. This number is the gross pay per pay period.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Total including employer contribution. The IRS reviews 401k contribution limits each year to determine when they need to be increased to keep pace with inflation.

A financial advisor in Wisconsin can help you understand how taxes fit into your overall financial goals. Click the Customize button above to learn more. Subtract any deductions and payroll taxes from the gross pay to get net pay.

If you earn 50000 a year for example you would need to save 417 a month before taxes to have 5000 saved at the end of a year. 401k HSA etc withheld from. Increasing your contribution will help you reach your retirement savings goals and it will also help you lower how much you pay in taxes.

Hourly Paycheck Calculator Enter up to six different hourly rates to estimate. How You Can Affect Your Wisconsin Paycheck. Check with your plan administrator for details.

A half times their regular rate of pay. A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals. If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Simply enter the length width and the cost per square meter of the material and you can instantly find out how much it will cost to complete your project.

The IRS contribution limit increases. 401k Catch-Up Contribution Limit for 2022. The square metre cost calculator exactly as you see it above is 100.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. For example suppose you had gross pay of 50000 a year and got paid every two weeks. Money that you contribute to a.

The grams to ounces g to oz calculator exactly as you see it above is 100 free for you to use. Payroll 401k and tax calculators. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Click on the options above to add the square feet to cubic feet calculator to your website free of charge share the calculator via Facebook Twitter Digg or. That may involve doing some math ahead of time to determine the right deferral amount per paycheck so they dont go over the limit and incur a penalty tax.

Download 401k Calculator Excel Template Exceldatapro

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401 K Calculator Mycalculators Com

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How To Budget When You Are Behind On Bills Setting Up A Budget Budgeting Money Budgeting

Download 401k Calculator Excel Template Exceldatapro

9 Best Free Paycheck Calculator Online Amazon Seller News Today

7 Best Free Online 401k Calculator Websites

4 Steps To Paying Off Debt Girltalkwithfo Com Credit Card Payment How To Calculate Credit Card Payment Cr Debt Payoff Debt Free Credit Card Debt Payoff

401k Calculator

Paycheck Calculator Take Home Pay Calculator

401 K Calculator Paycheck Tools National Payroll Week

401k Contribution Calculator Step By Step Guide With Examples

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How Does A Debt Snowball Work Credit Card Interest Rate Ideas Of Credit Card Interest Rate Creditcard Int Debt Snowball Debt Calculator Money Management

401 K Calculator Credit Karma

401 K Retirement Calculator With Save Your Raise Feature